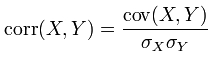

HP 10bll+ Financial Calculator - How do i calculate sample covariance?

Options

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

turn on suggested results

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Guidelines

From questions to kudos — grow your reputation as a tech expert with HP Support! Click here to sign up.